“We often plough so much energy into the big picture, we forget the pixels.” – Silvia Cartwright

As highlighted last week, the focus is on equities this week. Instead of the usual text heavy approach, we do a quick run through of more than a handful of US stocks including some that we already hold, would like to add to our holdings, and consider as candidates for the short side.

The approach we have taken is as thematic as we could possibly make it. Stocks that do not fall under a theme have been left out of today’s piece, we will aim to issue a follow-up piece in the next week or two to cover individual stocks that we are monitoring but do not neatly fit under a clear investment theme at present.

[Note that our typical investment horizon ranges from 6 to 18 eighteen months for any position. With the caveat that if a stock significantly re-rates higher or lower due to a material development or otherwise, we may exit the position sooner.]

Semiconductors and Fabrication

In AIG, Robert E. Lighthizer, Made in China 2025, and the Semiconductors Bull Market we wrote:

Investors often talk about the one dominant factor that drives a stock. While we consider capital markets to be more nuanced than that, if semiconductor stocks have a dominant factor it surely has to be supply – it certainly is not trailing price-to-earnings multiples as semiconductor stocks, such as Micron, have been known to crash when trading at very low trailing multiples. Chinese supply in semiconductors is coming.

While we expect the bull market in tech stocks to re-establish itself sometime this year, if there was one area we would avoid it would be semiconductors.

Supply related concerns and forward earnings expectations reaching unreasonable levels have certainly slowed the upward march of semiconductor stocks; and we are seeing weakness across the semiconductors and fabrication spectrum. We consider the following stocks as potential candidates for shorting.

ON Semiconductor $ON

A spin-off of Motorola, $ON supplies semiconductor products across a wide spectrum of end-uses including those for power and signal management, logic, discrete, and custom devices for automotive, communications, computing, consumer, industrial, LED lighting, medical, military/aerospace and power applications.

As per Bloomberg, there are 21 analysts recommendations for the stock, 14 of them buys, an 5 holds and only 2 sells.

If the company disappoints, as we suspect that it will, a flurry of downgrades could well push the stock much lower.

Cypress $CY

$CY designs and manufactures programmable system-on-chip integrated circuits, USB and touchscreen controllers, and programmable clocks for the automotive, industrial, home automation and appliances, consumer electronics and medical products industries.

Entegris $ENTG

$ENTG designs and manufactures contamination control, microenvironment, and specialty materials products and systems to purify, protect, and transport critical materials used in the semiconductor device fabrication process.

As per Bloomberg, the stock current trades almost 30% below the average target price of the 11 analysts that cover the stock.

Marvell Technology $MRVL

$MRVL designs analog, digital, mixed-signal and microprocessor integrated circuits for storage, telecommunications, cloud storage and consumer markets.

Retail

According to data released earlier this week, retail sales rose a seasonally adjusted 0.5 per cent in July from the prior month, well ahead of economists’ forecasts for a 0.1 per cent increase.

Year-over-year retail sales are up a robust 6.4 per cent, tracking well ahead of inflation, as measured by the consumer price index.

Low unemployment levels combined with the windfall from tax cuts is contributing to strong consumer sentiment and high levels of spending across the majority of retail categories.

We have already witnessed Walmart $WMT reporting its strongest US sales growth in more than a decade, which sent the stock soaring higher. We have been long $WMT since September last year and at the time of initiating the positioning, we wrote:

$WMT’s revenue growth has flat lined in recent years as wage growth has been trendless. As wage growth picks up, we expect investors to increasingly come to recognise $WMT’s growth potential

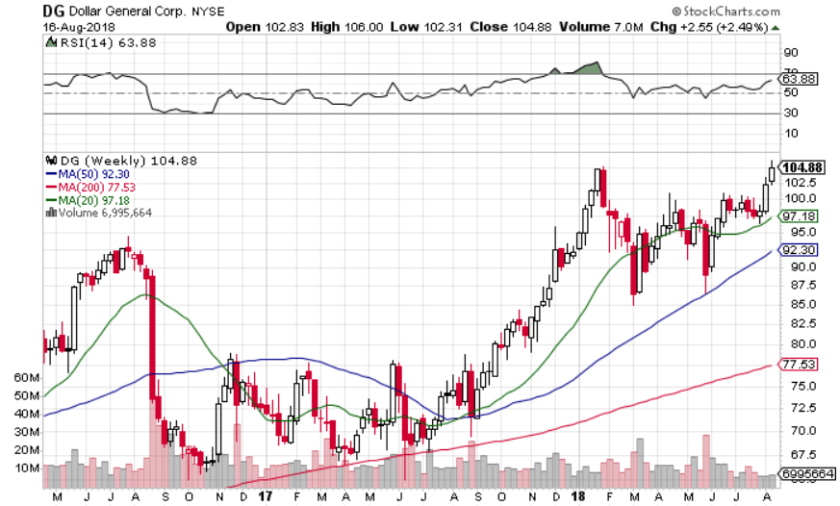

Another retail name we have been long is Dollar General $DG, we initiated a position in the stock in November last year.

We still expect further upside in both $WMT and $DG and continue to hold them. Generally, we continue to see strength across the retail complex and may look to add long positions in at least two more stocks.

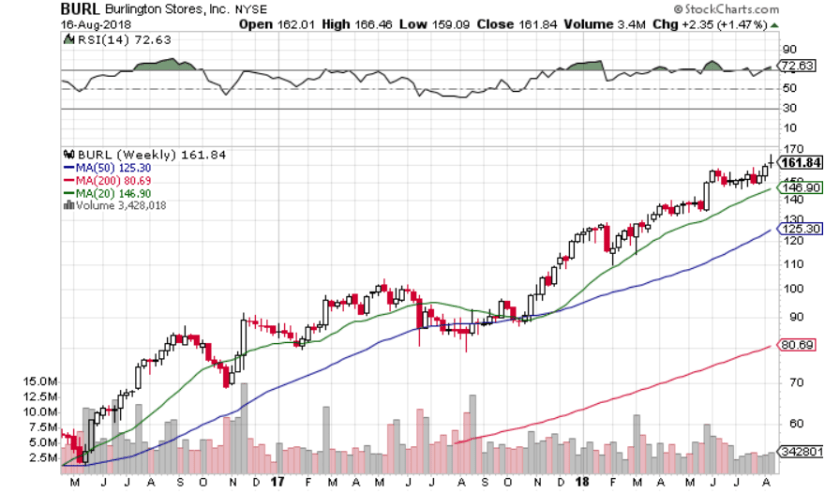

Burlington Stores $BURL

$BURL operates more than 630 off-price department stores across the US.

The company is expected to report quarterly earnings on 22 Aug with consensus analyst estimates for earnings growth of 33 per cent for the quarter, and 37 per cent growth for the full year. Annual earnings estimates were recently revised upward.

Dunkin’ Brands Group $DNKN

$DNKN is a restaurant holding company and franchiser of two chains of quick service restaurants: Dunkin’ Donuts and Baskin Robbins. The company franchises over 20,000 Dunkin’ Donuts and Baskin Robbins ice cream parlours in the US and across 60 international markets.

Payment Processing

Driven by the rise of global e-commerce and internet-connected mobile devices, physical money is being snubbed in favour of cards and other digital payment options. According to Capgemini, global non-cash transactions are expect to grow at CAGR of 10.9 per cent between 2015 and 2020 and reach US dollars 725 billion.

This secular trend toward ever increasing non-cash transactions is in favour of payment processors – both the near ubiquitous players (e.g. VISA and MasterCard) and niche solutions providers.

We added FleetCor Technologies $FLT to our long trade ideas in June.

$FLT is an independent provider of specialised payment products and services to commercial fleets, major oil companies and petroleum markets.

The company’s payment cards provide significant savings and benefits to local fleets, including purchase controls, lower fraud, and specialised reporting. Penetration levels for the payment cards are relatively low at around 50% and there is significant potential for the company to gradually increase penetration levels.

We continue to hold the stock.

Cardtronics $CATM

We will be looking to add $CATM as a second name under the payment processing theme.

$CATM is the world’s largest non-bank ATM operator and a leading provider of fully integrated ATM and financial kiosk products and services.

The company owns Allpoint, an interbank network connecting ATMs. Allpoint offers surcharge-free transactions at ATMs in its network and operates in the US, Canada, Mexico, United Kingdom, and Australia.

Allpoint is in the business of supporting any financial institution provide an ATM network to rival the very largest banks. Allpoint today offers more than 55,000 surcharge-free ATMs to over 1,000 financial institutions.

$CATM’s has recently updated its strategy to increasingly focus on expanding Allpoint’s network and penetration amongst financial institutions.

The company’s strategy update has been accompanied by a strong level of insider buying.

Energy Infrastructure and Mid-Stream Services

In April we issued a piece on the opportunities arising out of the infrastructure bottlenecks in shale patch in the US – Oil: Opportunities Arising from Infrastructure Bottlenecks.

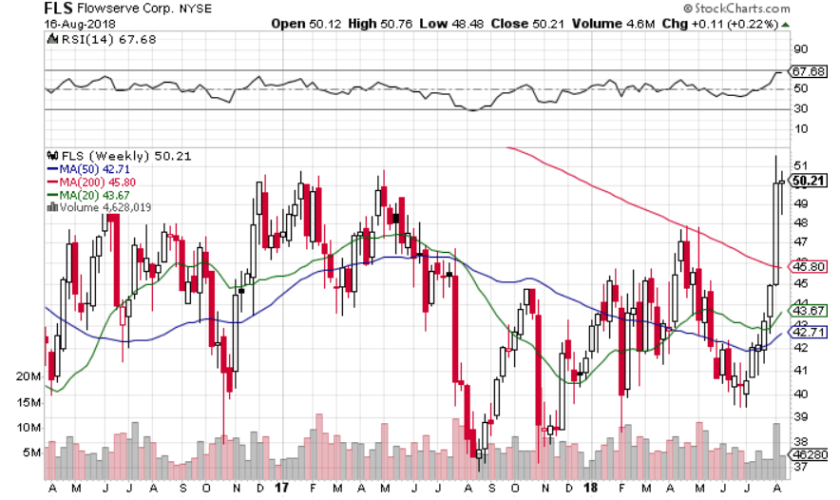

At the time we identified two industrial equipment suppliers that could benefit from increased demand originating from the shale patch: SPX Flow $FLOW and Flowserve $FLS. Although the stocks have yet to perform we continue to see significant opportunities in the energy infrastructure space and hold on to them.

Given the scale of the opportunity in the sector, we think there is a lot of room to add additional names to better play the overall theme.

IDEX Corp $IEX

$IEX is engaged in the development, design, and manufacture of fluid handling systems, and specialty engineered products.Its products include pumps, clamping systems, flow meters, optical filters, powder processing equipment, hydraulic rescue tools, and fire suppression equipment, are used in a variety of industries.

UGI Corp $UGI

$UGI is a holding company with interests in propane and butane distribution, natural gas and electric distribution services.

Targa Resources Corp $TRGP

$TRGP is one of the largest providers of natural gas and natural gas liquids in the US. The company’s operations are predominantly concentrated on the Gulf Coast, particularly in Texas and Louisiana.

Digitalisation

Digitisation is the process of converting information from a physical format into a digital one. When this process is utilised to automate and / or enhance business processes and activities, it is referred to ‘digitalisation’.

Digitalisation is concerned with businesses adopting digital technologies to create new revenue streams and / or improving operational processes. Digitalisation is not something new, businesses have been actively engaged in digitalising their operations for decades. The rise of big data, Moore’s law continuing to hold true as it relates to integrated circuits and the ever dropping cost of electronic components, however, has meant that its adoption has started to accelerate in recent years.

Amazon’s supermarket with no checkouts is an example of an outcome when a business fully embraces digitalisation.

We currently do not have any open positions under this theme. We are looking to add longs in two names.

Trimble $TRMB

$TRMB developer of Global Navigation Satellite System receivers, laser rangefinders, unmanned aerial vehicles , inertial navigation systems and software processing tools. The company is best known for its for GPS technology.

The company provides integrated solutions that enable businesses to to collect, manage and analyse complex information.

$TRMB is renowned for having deep domain knowledge of the industries it provides integrated solutions for and generally caters markets ripe for or undergoing rapid digitalisation.

Zebra Technologies $ZBRA

$ZBRA is in the business of enterprise tracking and manufactures and sells marking, tracking and computer printing technologies primarily to the retail, manufacturing supply chain, healthcare and public sectors. Its products include direct thermal and thermal transfer printers, RFID printers and encoders, dye sublimation card printers, handheld readers and antennas, and card and kiosk printers.

The company achieved an adjusted EPS of US dollars 2.48 a share in the second quarter, up 64 per cent year-over-year. Sales rose 13 per cent to US dollars 1.012 billion. The company beat consensus estimates of US dollars 2.23 in EPS and sales US dollars $989 million.

Software as a Service (SaaS)

We quote from venture capitalist Marc Andreessen’s seminal essay from 2011:

“This week, Hewlett-Packard (where I am on the board) announced that it is exploring jettisoning its struggling PC business in favor of investing more heavily in software, where it sees better potential for growth. Meanwhile, Google plans to buy up the cellphone handset maker Motorola Mobility. Both moves surprised the tech world. But both moves are also in line with a trend I’ve observed, one that makes me optimistic about the future growth of the American and world economies, despite the recent turmoil in the stock market.

In short, software is eating the world.”

Mr Andreessen’s words ring just as true today as they did back in 2011. Software, specifically SaaS, has continued to proliferate and we have increasingly witnessed the rise of SaaS companies that provide solutions tailored to the needs of individual industries or specific functions within a business.

We are looking to go long two names under this theme.

Paycom $PAYC

$PAYC designs and develops cloud-based human capital management software solutions to support businesses in managing the entire employment life cycle.

$PAYC is a highly disruptive company that is successfully displacing entrenched incumbents across the payroll management space.

Businesses tend to use software to make their employees’ lives easier and to reduce their day-to-day administrative burden. Ask any business, big or small, they will tell you that compliance is a major headache. And there is a lot businesses have to comply with, particularly in the US. Payroll software allows businesses to comply with tax and other payroll related laws. $PAYC started life as a payroll management software provider.

$PAYC’s software solutions have long since evolved beyond payroll management and include applications for talent management, recruitment and general human capital management. Payroll management is serves as the company’s entry product for new customers and the added solutions provide $PAYC with the opportunity to gradually up sell existing customers.

Veeva Systems $VEEV

$VEEV is a cloud-computing company focused on providing solutions for the sales and marketing functions within the pharmaceutical and life sciences industries. The company’s software helps pharmaceutical companies manage customer databases, track drug developments, and organize clinical trials. The software has been widely adopted by ‘Big Pharma’.

The company’s lower-cost and tailored approach has enabled it to upend the on premise software providers such as SAP and Oracle in the pharmaceutical and life sciences sectors.

While the company maintains its core focus in life sciences, it is gradually broadening its products’ functionality to enable it to up sell existing clients and to potentially enter into new industry segments.

Plenty of names for you to chew on for this week. If you would like to discuss any of the names in more detail or to talk you through our more detailed investment cases, feel free to reach out to us over email or by direct message on Twitter.

This post should not be considered as investment advice or a recommendation to purchase any particular security, strategy or investment product. References to specific securities and issuers are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.