“Every day is a bank account, and time is our currency. No one is rich, no one is poor, we’ve got 24 hours each.” – Christopher Rice, bestselling author

“He tried to read an elementary economics text; it bored him past endurance, it was like listening to somebody interminably recounting a long and stupid dream. He could not force himself to understand how banks functioned and so forth, because all the operations of capitalism were as meaningless to him as the rites of a primitive religion, as barbaric, as elaborate, and as unnecessary. In a human sacrifice to deity there might be at least a mistaken and terrible beauty; in the rites of the moneychangers, where greed, laziness, and envy were assumed to move all men’s acts, even the terrible became banal.” – Excerpt from The Dispossessed by Ursula K. Le Guin

“A bank is a place that will lend you money if you can prove that you don’t need it.” – Bob Hope

Before we get to the update, just a quick comment on the New York Times op-ed “I Am Part of the Resistance Inside the Trump Administration” written by a hitherto anonymous member of the Trump Administration, which we suspect many of you have already read. Our reaction to the piece is that an “elite” politician issuing an editorial in a highbrow broadsheet and talking of resistance against the President is far more likely to stoke populism than to weaken it. Moreover, as angry as President Trump may appear to be about the editorial on television, it gives him just the kind of ammunition he needs to drum up the “us against them” rhetoric and rouse his core supporters to turn up to vote during the forthcoming mid-term elections.

Moving swiftly on, this week we write about US financials.

Financials have not had a great year so far. The MSCI US Financials Index is up less than one per cent year-to-date, tracking almost 7 per cent below the performance of the S&P500 Index. While the equivalent financials indices for Japan and Europe are both down more than 11 per cent year to date.

At the beginning of the year, investors and the analyst community appeared to be positive on the prospects for the financial sector. And who can blame them? The Trump Tax Plan had made it through Congress, the global economy was experiencing synchronised growth, progress was being made on slashing the onerous regulations that had been placed on the sector in the aftermath of the global financial crisis, and banks’ net interest margins were poised to expand with the Fed expected to continue on its path of rate hikes.

So what happened?

We think US financials’ under performance can in large part be explained by the flattening of the US yield curve, which in turn can result in shrinking net interest margins and thus declining earnings. The long-end of the US yield curve has remained stubbornly in place, for example 30-year yields still have not breached 3.25 per cent, and all the while the Fed has continued to hike interest rates and pushed up the short-end of the curve.

Why has the long-end not moved?

There are countless reasons given for the flattening of the yield curve. Many of them point to the track record of a flattening and / or inverted yield curve front running a recession and thus conclude with expectations of an imminent recession.

The Fed and its regional banks are divided over the issue. In a note issued by the Fed in June, Don’t Fear the Yield Curve, the authors conclude that the “the near-term forward spread is highly significant; all else being equal, when it falls from its mean level by one standard deviation (about 80 basis points) the probability of recession increases by 35 percentage points. In contrast, the estimated effect of the competing long-term spread on the probability of recession is economically small and not statistically different from zero.”

Atlanta Fed President, Mr Raphael Bostic, and his colleagues on the other hand see “Any inversion of any sort is a sure fire sign of a recession”. While the San Francisco Fed notes that “[T]he recent evolution of the yield curve suggests that recession risk might be rising. Still, the flattening yield curve provides no sign of an impending recession”.

Colour us biased but we think the flattening of the yield curve is less to do with subdued inflation expectations or deteriorating economic prospects in the US and far more to do with (1) taxation and (2) a higher oil price.

US companies have a window of opportunity to benefit from an added tax break this year by maximising their pension contributions. Pension contributions made through mid-September of this year can be deducted from income on tax returns being filed for 2017 — when the U.S. corporate tax rate was still 35 per cent as compared to the 21 per cent in 2018. This one-time incentive has encouraged US corporations to bring forward pension plan contributions. New York based Wolfe Research estimates that defined-benefit plan contributions by companies in the Russell 3000 Index may exceed US dollars 90 billion by the mid-September cut-off – US dollars 81 billion higher than their contributions last year.

US Companies making pension plan contributions through mid-September and deducting them from the prior year’s tax return is not new. The difference this year is the tax rate cut and the financial incentive it provides for pulling contributions forward.

Given that a significant portion of assets in most pension plans are invested in long-dated US Treasury securities, the pulled forward contributions have increased demand for 10- and 30-year treasuries and pushed down long-term yields.

Higher oil prices, we think, have also contributed to a flattening of the yield curve.

Oil exporting nations have long been a stable source of demand for US Treasury securities but remained largely absent from the market between late 2014 through 2017 due to the sharp drop in oil prices in late 2014. During this time these nations, particularly those with currencies pegged to the US dollar, have taken drastic steps to cut back government expenditures and restructure their economies to better cope with lower oil prices.

With WTI prices above the price of US dollars 65 per barrel many of the oil exporting nations are now generating surpluses. These surpluses in turn are being recycled into US Treasury securities. The resurgence of this long-standing buyer of US Treasury securities has added to the demand for treasuries and subdued long-term yields.

Investment Perspective

A question we have been recently asked is: Can the US equity bull market continue with the banking sector continuing to under perform?

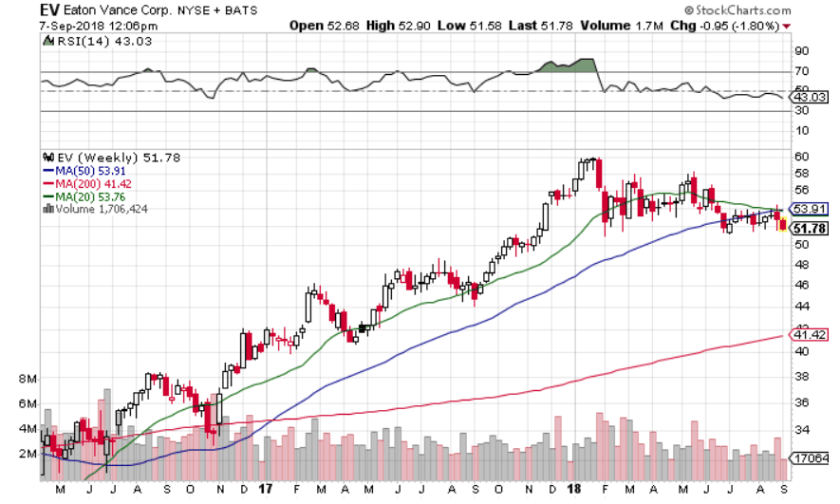

Our response is to wait to see how the yield curve evolves after the accelerated demand for treasuries from pension funds goes away. Till then it is very difficult to make a definitive call and for now we consider it prudent to add short positions in individual financials stocks as a portfolio hedge to our overall US equities allocation while also avoiding long positions in the sector.

We have identified three financials stocks that we consider as strong candidates to short.

Synovus Financial Corp $SNV

Western Alliance Bancorp $WAL

Eaton Vance Corp $EV

This post should not be considered as investment advice or a recommendation to purchase any particular security, strategy or investment product. References to specific securities and issuers are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.