A somewhat lengthy piece discussing some of the psychological hindrances all of us face from time-to-time in investing and trading pursuits.

We share one chart right at the end of the piece with little comment, which is the basis of our expectation that the US equity market is to see new highs still.

The Science of Tribalism

“Everybody wants to protect their own tribe, whether they are right or wrong.” ― Charles Barkley

While watching television, have you ever looked away or squealed in response to a gruesome scene, the kind that became a regular occurrence on HBO’s Game of Thrones? Turns out, this is because the imagery activates our brain’s empathy network, which then stimulates brain areas involved in the sensation of our own pain.

Neuroimaging studies have revealed that watching another person in pain triggers brain areas that are active when we feel pain. The neural response to seeing others in pain, however, is not constant; rather it is modulated by context and by allegiances.

Neuroscientist David Eagleman used functional magnetic resonance imaging (fMRI) to measure the response in the brain’s empathy network. He examined the brains of people watching videos of other people’s hand getting pricked by a needle or touched by a Q-tip. When the hand being pricked by the needle was labelled with the participant’s own religion, the participant’s empathy network showed a larger spike of activity than when the hand was labelled with a different religion.

More surprisingly, when participants were assigned to an arbitrary group immediately before the subject entered the MRI machine, and the hand being pricked was labelled as belonging to the same arbitrary group as the participant, the participant’s brain still showed a larger spike ― even though the grouping did not exist just moments earlier!

Participants also exhibited a diminished response in their empathy networks if they believed the pain-recipient has acted unfairly in a simple economic exchange or were told that the victim is receiving a large monetary compensation for undergoing the pain.

Commitment and Consistency

“Consistency is the hallmark of the unimaginative.” ― Oscar Wilde

Last week we were forwarded a quarterly commentary and portfolio review for a fund managed by a self-proclaimed “old-school value investor”. The commentary was standard fare really, espousing the well-known values of Graham and Dodd and Buffet and Munger schools of investing as would be expected from a value-oriented manager. The fund manager was particularly insistent that they only buy “companies at a big discount to the present value of their future cash flows”.

As we turned to the section listing the fund’s top holdings, that too read like a standard portfolio that we had seen from countless other value managers. There was a lot of Google in the portfolio, a little Apple, a few big-name financial stocks and a not-so-insignificant allocation to General Motors. Except there was one holding which we did not expect, Netflix. And seeing it in the list of holdings, one of top-five in terms of allocation, irked us. Reading the commentary already felt like it was not the best use of our time but after seeing Netflix in the portfolio, the feeling changed to that of being cheated somehow.

Feeling cheated after reading the commentary and seeing the holdings for a fund we are not invested in, strange right?

The following passage is excerpted from Influence: The Psychology of Persuasion by Robert B. Caldini (emphasis added):

Psychologists have long understood the power of the consistency principle to direct human action. Prominent early theorists such as Leon Festinger (1957), Fritz Heider (1946), and Theodore Newcomb (1953) viewed the desire for consistency as a central motivator of behavior. Is this tendency to be consistent really strong enough to compel us to do what we ordinarily would not want to do? There is no question about it. The drive to be (and look) consistent constitutes a highly potent weapon of social influence, often causing us to act in ways that are clearly contrary to our own best interest.

Consider what happened when researchers staged thefts on a New York City beach to see if onlookers would risk personal harm to halt the crime. In the study, an accomplice of the researchers would put a beach blanket down five feet from the blanket of a randomly chosen individual—the experimental subject. After several minutes of relaxing on the blanket and listening to music from a portable radio, the accomplice would stand up and leave the blanket to stroll down the beach. Soon thereafter, a researcher, pretending to be a thief, would approach, grab the radio, and try to hurry away with it. As you might guess, under normal conditions, subjects were very reluctant to put themselves in harm’s way by challenging the thief—only four people did so in the 20 times that the theft was staged. But when the same procedure was tried another 20 times with a slight twist, the results were drastically different. In these incidents, before leaving the blanket, the accomplice would simply ask the subject to please “watch my things,” something everyone agreed to do. Now, propelled by the rule for consistency, 19 of the 20 subjects became virtual vigilantes, running after and stopping the thief, demanding an explanation, often restraining the thief physically or snatching the radio away (Moriarty, 1975).

To understand why consistency is so powerful a motive, we should recognize that, in most circumstances, consistency is valued and adaptive. Inconsistency is commonly thought to be an undesirable personality trait (Allgeier, Byrne, Brooks, & Revnes, 1979; Asch, 1946). The person whose beliefs, words, and deeds don’t match is seen as confused, two-faced, even mentally ill. On the other side, a high degree of consistency is normally associated with personal and intellectual strength. It is the heart of logic, rationality, stability, and honesty.

The fund manager was inconsistent. He championed investing in “companies at a big discount to the present value of their future cash flows” and then went ahead and owned Netflix. The gall of it!

The Incompatibility of Tribalism and Consistency in a Volatile Market

Our vocation is such that we are often engaged in debate. On the merits of buying one security over another. On the signals from one asset class for the prospects of another asset class. On the reaction function of the Federal Reserve to the latest release of economic data. And on many other topics much like these.

Over the last eighteen or so months, markets have been extraordinarily challenging.

US stocks have rallied, sold off, rallied sharply, sold off sharply, rallied sharply and now started to chop. G-7 governments have sold-off with the US ten-year reaching yields of 3 per cent and then rallied to record low yields. The trade-dispute between the US and China has escalated, de-escalated and escalated again on more occasions than we care to recall. Bitcoin lost more than two-thirds of its value, then tripled and then halved. Repo rates spiked for reasons no-one can fully comprehend. Oil witnessed the re-emergence of a geopolitical premium only for it to subside almost instantly.

In our discussions and debates, we have found that a fair share of traders, active managers and asset allocators are, more than ever, struggling to keep up, let alone outperform, broader market indices. Markets are never easy, in these challenging climes even less so. Nonetheless, two of the recurring hindrances to better performance we have increasingly noticed are tribalism and consistency.

Tribalism in Social Media and Investment Decision Making

Tribalism can be easy to spot. Just go on to Twitter and you will find bond bulls re-tweeting bond bulls, goldbugs sharing articles of Paul Tudor Jones stating that gold is his best idea for the next two years, equity market bears praising the analysis of other bearish analysts, Tesla bulls and bears slinging mud at each other, the examples are countless. Worse still, try debating with someone you do not know but disagree with and present factual data that invalidates their view and you are likely to be blocked more often than you would expect.

Tribalism in a social media context leads to filter bubbles and to the consumption of news, views and research that confirms that which we already know or believe. The utility of a social media platform, such as Twitter, to a user is significantly reduced by tribal behaviour. It has never been easier, faster and cheaper to seek out and obtain a variant perception. Investment professionals and traders would be better served and probably see improving performance if they used social media platforms more to seek out non-conforming views rather than searching for the false sense of security that belonging to arbitrary Twitter tribe would bring.

In professional settings tribalism is less of a problem but at the same time harder to spot. At investment firms, it usually manifests in team members with non-consensus views or opinions being cast aside in the investment decision making process.

Tribalism can lead to poor investment decision making when good ideas are rejected because they are put forth by those long belonging to the ‘other tribe’ and bad ideas presented by those belong to ‘our tribe’ are accepted.

Worse still, is the case of tribal behaviour on social media that creeps into professional settings. If you are wondering if it really happens, we recently attended a meeting with a prospective client where one of the analysts quoted recent tweets by three, to remain unnamed, permabears to make a case against an allocation to US equities.

Consistency is the Real Enemy

“Laziness isn’t merely a physical phenomenon,about being a couch potato,stuffing your face with fries and watching cricket all day. It’s a mental thing, too, and that’s the part I have never aspired for.” ― Shah Rukh Khan, Indian actor, film producer, and television personality

While tribalism can be toxic, it is consistency that can be the real enemy in the investment decision making process.

Since a “high degree of consistency is normally associated with personal and intellectual strength” it usually serves one’s interests to remain consistent. The downside, however, is that this fosters almost blind consistency which is detrimental, and at times outright disastrous, in the process of investment decision making.

Blind consistency, outside of investment decision making, has its attractions. For starters, it frees up our mental resources by giving us a relatively effortless means for dealing with the complexities of daily life that make severe demands on our mental energies and capacities. Having made up our mind about an issue, blind consistency allows us to stop thinking about the issue and when confronted with the issue we only react in a manner consistent with our earlier decision.

Another attraction of mechanically reacting to an issue is that it protects us from the uncomfortable truth that we may be wrong. If we never expend the energy to understand the counter-argument, and reject it off the bat, we never have to confront the possibility that we may wrong.

Consider the following (real life) examples and if any resonate with you.

Bond bulls who will exit their bonds positions to lock in profits but will never go long stocks because a recession is always just around the corner.

– Gold bears that short at the lows because it’s a ‘barbarous relic’ and fail to cover or go long even as real rates are collapsing.

– Federal Reserve critics that see every market jitter as further confirmation of central banker incompetence but have not taken the time to understand the intricacies of the financial system.

– US dollar bulls that never go long another currency against the greenback even as it becomes painfully obvious that a rally has become over stretched.

– Permabears that told you that Apple was done after the ‘failed’ iPhone 5 and now poo-poo over the company’s services narrative.

– The bearish fund manager that identifies the flaw in his framework that led them to catastrophically underperform over the last decade somehow finds that the updated framework indicates that is time to short US stocks.

– The technical analyst that shows you analogs of today’s US market performance versus sometime leading up to the crash in 1929, 1987, 2008 or any other market crash that can be found or compressed to fit the narrative but never one that shows the market going higher.

All of the above examples are of blindly consistent people. In any other context you would respect them. In an investment context, they would have at times cost you money, a lot of it. In many instances it is acceptable to underperform. It is, however, unacceptable to underperform because you were unwilling to do the work or to appear inconsistent.

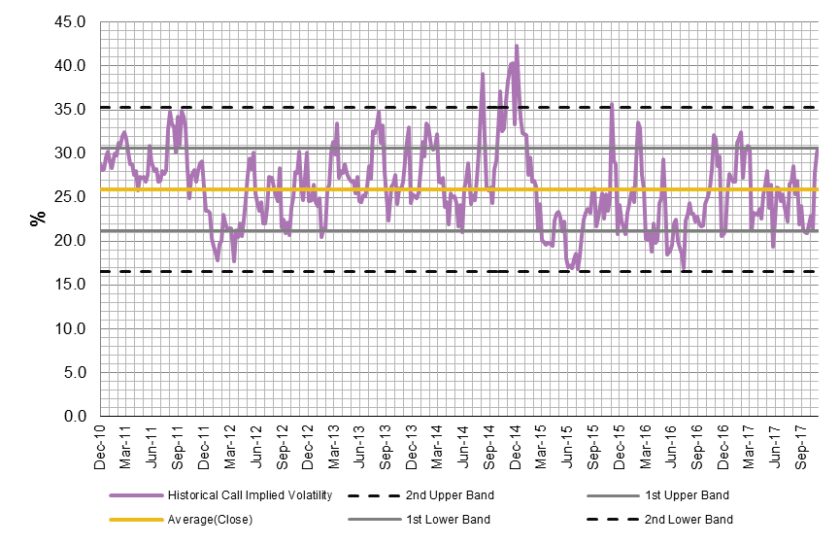

Improving Liquidity Indicators Suggest New Highs Still to Come

Combine the below with the three charts we shared last week and the prospect of the S&P 500 reaching levels 10 to 15 per cent higher from here is not altogether unreasonable.

Thanks for reading and please share!

This post should not be considered as investment advice or a recommendation to purchase any particular security, strategy or investment product. References to specific securities and issuers are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed

Source: Bloomberg

Source: Bloomberg Source: Bloomberg

Source: Bloomberg Source: Bloomberg

Source: Bloomberg

Source: Bloomberg

Source: Bloomberg Source: Bloomberg

Source: Bloomberg Source: Bloomberg

Source: Bloomberg Source: Bloomberg

Source: Bloomberg Source: Bloomberg

Source: Bloomberg Source: Bloomberg

Source: Bloomberg